Agentic Commerce: The Insurance Distribution Takeover

In the context of our newly launched Agentic AI Enterprise Blueprint we deep dive here on one of the most advanced forms of Agentic AI - ‘Agentic Commerce’. It’s still early days, but it’s going to have a profound impact on the economy. In this article we deep dive on its impact on insurance, one of the most exposed sectors to AI automation and augmentation. The key principles apply to most knowledge-intensive sectors.

Introduction

Walmart, the world’s biggest retailer, recently announced it is now deploying ChatGPT-integrated shopping to 270 million customers. Visa and Mastercard have launched agent-ready payment rails. McKinsey projects $3-5 trillion in global agentic commerce by 2030.

For insurance, this isn't a future threat — this is operational infrastructure that could reshape the distribution of trillions of dollars in annual premium. The window to establish a strong and differentiated agent-first positioning is about 12-18 months before algorithmic trust patterns solidify.

Most carriers lack critical infrastructure today — particularly the identity systems that enable autonomous agent-to-agent transactions. Europe's regulatory mandates open up first-mover advantages.

At AI Risk we believe the strategic choice is binary: Lead this transformation or become invisible to the algorithms that increasingly mediate insurance distribution

Understanding Agentic Commerce

Agentic commerce represents the shift from human-driven commerce to AI agent-driven transactions. Rather than consumers or employees manually searching, comparing, and purchasing, they delegate these functions to AI agents:

Traditional: Consumer visits 5 carrier websites, fills 5 quote forms, manually compares

Agentic: Consumer's AI agent queries 50 carriers via API, compares coverage-to-cost ratios, shortlists 3 optimal options—in seconds

The strategic threat: Carriers, brokers or others not accessible to agents never reach the consideration set, regardless of their actual offerings.

What’s inside this article?

This article answers five critical questions:

1. Which insurance products face agent-driven disruption first, and on what timeline? (Spoiler: standardized commercial and personal lines have 12-18 months)

2. Who provides the consumer and enterprise AI agents — and why can't you predict who will win?

3. What infrastructure gap will break most carrier agent strategies, and why is UK/Europe likely to leapfrog ahead?

4. Why is "wait and see" the highest-risk choice, not the prudent one?

5. What's your sector-specific six-month action plan to establish agent-first positioning before visibility patterns solidify?

What’s Changed?

Walmart's October partnership with OpenAI enables 270 million weekly customers to shop through ChatGPT using Instant Checkout. Customers describe needs in natural language — "I need ingredients for chicken tacos for four" — and ChatGPT searches inventory, compares options, and completes the purchase autonomously.

CEO Doug McMillon: "eCommerce shopping experiences have consisted of a search bar and a long list. That is about to change."

If consumers delegate grocery shopping to AI, they'll certainly delegate insurance shopping.

The payment infrastructure is now live. Visa's Intelligent Commerce, Mastercard's Agent Pay, and Google's Agent Payments Protocol create converging infrastructure. By Q4 2026, AI agents will search for insurance, compare policies, and execute purchases autonomously.

The numbers confirm acceleration: 44% of AI search users now prefer it as their primary source versus 31% for traditional search.

Why Insurance Faces Acute Vulnerability

Insurance is uniquely exposed through five factors:

Standardized products, price-sensitive consumers: Insurance comparison is tedious — consumers want to delegate this. Visa notes AI agents excel at 'boring' or 'complicated' purchases. Insurance is both.

Complex comparison processes: The complexity that has protected incumbents becomes a liability – AI can do it better.

Renewal vulnerability: Annual renewals create persistent exposure. Consumer agents will conduct automated policy reviews across dozens of carriers simultaneously.

Intermediary commoditization: When AI agents query every carrier's API in milliseconds, aggregation becomes instant.

Hidden information architecture: Most carriers hide pricing behind forms — invisible to AI. Carriers with agent-readable APIs capture disproportionate share in early pilots.

‘Level 5’ Ecosystem Agents: Becoming Operational

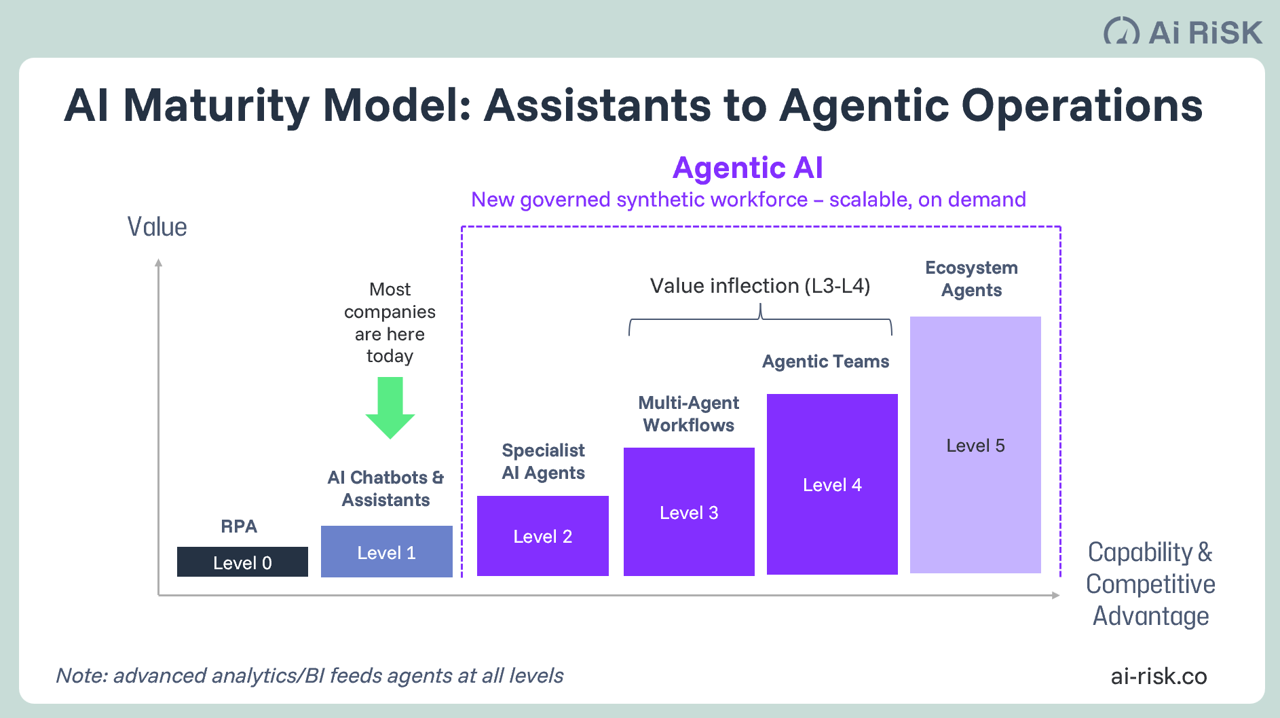

This transformation is no longer theoretical. Ecosystem agents (‘Level 5’ in AI Risk’s AI Maturity Model) — capable of autonomous cross-organizational transactions — are starting to become operational today.

More details of our AI Maturity Model here: https://www.ai-risk.co/our-insights-agentic-enterprise/the-agentic-ai-maturity-model

We have identified five models of interaction for Agentic Commerce in Insurance that operate across a sophistication spectrum: from simple website scraping (operational today) to fully autonomous agent-to-agent negotiation, as shown in the diagram below.

Let’s look at each of them in more detail and when we might expect to see them in the market:

Model 1: Agent to Website

Description: AI agent navigates carrier websites, extracts pricing and coverage information, presents findings to human buyer

Examples:

B2C: Apple Intelligence scrapes Aviva's website, extracts home insurance rates for comparison

B2B: Microsoft Copilot scans Allianz's website, downloads D&O policy documents, flags coverage gaps

Timing: 2025 (Operational now)

Requirements:

Agent-parseable website structure

Semantic markup

Public pricing visibility

Automation Level: Low (agent researches, human decides and transacts)

Key Implication: Website design determines visibility to agents

Model 2: Agent-Assisted Human Expert

Description: AI agent discovers and pre-qualifies specialist brokers/advisors; human expert conducts actual placement or advice

Examples:

B2C: Consumer's agent discovers independent financial advisors specializing in pension planning, presents top 3 IFAs; or identifies health insurance specialists for complex medical needs

B2B: Enterprise agent searches for political risk insurance, identifies 3 Lloyd's syndicates with Latin America expertise, presents broker profiles to risk manager

Timing: 2026

Requirements:

Discoverable broker/advisor profiles

Searchable expertise credentials

Public case studies/placement history

Automation Level: Medium (agent discovers options, human selects expert and makes final decision)

Key Implication: Discoverability determines lead generation; expertise remains valuable but must be AI-findable

Model 3: Brokered Agent to Website

Description: Consumer/enterprise agent queries broker platform, which aggregates quotes from 20-50 carrier APIs and presents options

Examples:

B2C: Banking app agent queries Check24 API, which aggregates 40 carrier quotes for home insurance comparison

B2B: Procurement agent queries commercial insurance marketplace, receives structured quotes from 15 carriers

Timing: 2026-2027

Requirements:

Broker API infrastructure

Carrier APIs integrated with platforms

Structured data exchange protocols

Automation Level: High (agent compares, human approves, agent executes)

Key Implication: API quality and platform integration determine inclusion in agent shortlists

Model 4: Embedded Insurance

Description: Brand platform agent queries 10-20 carrier APIs, embeds optimal insurance into primary purchase transaction

Examples:

B2C: Tesla's platform agent queries 20 auto carriers at car delivery, embeds best rate in vehicle purchase; or N26 bank app embeds travel insurance at trip booking

B2B: SAP's platform agent finds optimal cyber insurance for each ERP customer, embeds in enterprise software subscription

Timing: 2026-2027

Requirements:

Real-time quote/bind APIs

White-label partnerships

Embedded UX integration

Revenue-sharing agreements

Automation Level: Very High (fully embedded, minimal friction, automatic bundling)

Key Implication: Platforms become distribution gatekeepers; carriers compete invisibly behind brand platforms

Model 5: Agent to Agent

Description: Consumer/enterprise agent negotiates directly with carrier's brand agent; autonomous transaction with credential verification

Examples:

B2C: ChatGPT agent negotiates with Allianz's brand agent for bundled auto+home coverage, completes purchase autonomously after verifying credentials

B2B: Salesforce agent negotiates D&O terms with AXA's commercial agent, exchanges verifiable credentials, binds coverage autonomously

Timing: 2027-2028

Requirements:

Carriers deploy brand agents

Digital Identity (DID) infrastructure (W3C Verifiable Credentials)

Trust registries

Agent-to-agent protocols

Automation Level: Complete (fully autonomous negotiation and transaction, no human intervention required)

Key Implication: Brand agents required for autonomous commerce; carriers without sophisticated agents become invisible.

Market Share Projection

We think we could see 5-10% of Western market distribution going through agentic channels in 3 years’ time, rising to to 20-30% by 2030 as infrastructure matures. (See ‘Market Share Impact’ section below).

The 'Wait and See' Trap: Why Scepticism is Dangerous

Insurance executives facing this analysis typically respond with six objections. Each sounds prudent. Each is dangerous.

"We've heard digital hype before — this sounds like blockchain all over again."

Consumer behaviour has already changed: 44% prefer AI search over traditional search. Walmart is deploying grocery agents to 270 million customers. All other retailers across all sectors will follow. Consumers are already changing behaviour. Agentic commerce requires insurers to change infrastructure to meet behaviour that’s already shifted. You're responding to adoption, not betting on it.

"Our business is too complex — AI can't handle specialty commercial lines."

Partially correct, but completely irrelevant. Complex specialty won't fully automate for 24-36 months. But agents mediate discovery immediately. If the AI agents of corporate buyers search for "political risk insurance for Latin America operations" and your expertise is invisible because it's locked in PDFs, you've lost before the human sees your name. Complexity protects expertise, not invisibility.

"Customers won't trust AI with insurance decisions — it's too important."

Already disproven. Lemonade processes claims via AI with 90%+ satisfaction. Ping An's AI agents handle millions of policies. You're conflating delegation with decision. Customers already trust AI for shopping (Amazon) and financial advice (robo-advisors). They're delegating discovery and comparison, not necessarily final purchase. But if you're invisible during discovery, the final decision doesn't include you.

"Regulatory barriers will slow this down — we can wait."

The opposite is true. Europe's eIDAS 2.0, for example, mandates digital identity infrastructure by 2027. Trade body EIOPA is actively developing AI governance frameworks. Regulators are clearing the path, not blocking it. The regulatory risk is moving too slowly. Early movers work with regulators to shape frameworks. Late movers inherit restrictive rules designed around competitors' systems.

"We're too big/established to be disrupted this fast."

Blockbuster was ‘too big’. Kodak was ‘too big’. Your distribution network of 10,000 human agents becomes an anchor when consumer AI agents query every carrier simultaneously. Your brand equity built on emotional connection becomes invisible when algorithms evaluate coverage ratios and pricing efficiency. The first-mover advantage is structural: AI systems build confidence through repeated interactions, then default to those sources. This creates algorithmic lock-in measured in years.

Consulting firm BCG measured 4,700% year-over-year growth in GenAI-driven retail traffic. This isn't gradual adoption — it's phase transition. Carriers establishing agent-first positioning in the next 12-18 months will capture disproportionate share. Those who wait will spend 2027-2030 fighting for scraps where trust hierarchies are already established.

"Commercial insurance is relationship-driven, CFOs won't delegate to AI"

This confuses the human relationship with the discovery process. CFOs maintain broker relationships — but they're already delegating procurement analysis to enterprise software. When Microsoft Copilot suggests "You're overpaying for D&O by 18% — here are pre-qualified brokers who specialize in your industry," the CFO still calls their trusted broker — but only AFTER the agent has filtered the market. The threat isn't that CFOs abandon relationships. It's that enterprise agents determine which brokers make the consideration set. If you're not discoverable by Copilot, Salesforce AI, or SAP agents, you never get the call.

The Delegation Spectrum: Not All Products Face Equal Risk

Which insurance products get delegated to AI agents, by when?

Personal lines: Standardized products (auto, renters, credit protection) face full agent automation within 12-24 months. Complex, emotional products (whole life, annuities) take 24-36 months but agents dominate discovery.

Commercial lines: Standardized small commercial (business owners policies, standard workers comp) face 18-24 months to full automation. Mid-market commercial (policies up to $1M premium) takes 24-36 months with human approval. Expert-mediated large commercial (major D&O, political risk, aviation) requires 36+ months but enterprise agents pre-qualify specialty brokers—making discoverability critical.

Strategic reality: Even "low delegation" products lose if they're invisible during agent-driven discovery. Visibility patterns solidify within 12-24 months, creating persistent advantages for early movers.

These delegation patterns determine WHICH products face agentic disruption and WHEN. But a critical question remains: HOW MUCH market share actually shifts to new agent-driven channels? And how much represents transformation of existing channels rather than displacement? Understanding this distinction shapes whether you prepare for wholesale disruption or strategic transformation

Market Share Impact: Transformation vs. Displacement

Digitalisation has allowed insurance, finance and other services to be abstracted into software, modularised and distributed to developers, via APIs, like ‘lego bricks’. New intermediaries – insurtechs, digital MGAs/brokers, fintechs and now personal AI agents – are providing ‘operating systems’ that enable new forms of innovation and distribution.

A critical distinction shapes the strategic response of insurance players: channel ‘transformation’ is not the same as channel ‘displacement’.

Transformation means existing distribution channels adopt agentic AI infrastructure — carrier websites become agent-parseable, broker platforms expose APIs, comparison sites transform into agent-queryable services. The channel operates fundamentally differently, but the same organizations control distribution.

Displacement means new distribution channels capture market share from traditional channels — embedded insurance platforms (Amazon, Tesla, Revolut, SAP, AirBnB) bundle coverage at primary transactions, autonomous agents negotiate directly with carrier agents, traditional intermediaries lose share to platform gatekeepers.

The insurance industry faces both simultaneously. Understanding the difference determines whether you invest millions preparing for wholesale disruption or invest strategically to transform existing channels while capturing new distribution.

Three Types of Impact

Type 1: Operational Transformation (Affects 80-90% of market, minimal share displacement)

By 2027-2028, agentic AI transforms how most insurance distribution operates — without necessarily shifting who controls it.

Direct carriers deploy agent-parseable websites (Interaction Model 1), API infrastructure for platform integration (Model 3), and prepare for brand agents (Model 5). Operations modernize dramatically. Market share grows modestly as AI enables more efficient self-service. But these remain direct carrier channels.

Brokers and aggregators adopt AI discovery tools (Model 2), transform platforms into API-queryable services (Model 3), compete on data quality and carrier breadth rather than human advice for standardized products. Operations transform completely. Market share declines slightly as some standardized business shifts to embedded platforms.

Tied agents and branches face steeper decline. This compression predates agentic AI (driven by cost structure and digital preference) but accelerates as AI-enhanced direct and embedded channels become more competitive. Surviving tied agents adopt AI assistance tools and retreat to complex, high-touch products where relationships matter.

The key insight: These channels transform their technology and operations but remain the primary distribution routes. A broker using AI discovery tools is still a broker. A carrier with agent-accessible APIs still sells through the same channels — they just work differently.

Market share shift from transformation alone: ~0% by 2027-2028 (operational change within existing 85-90% of traditional channels)

Type 2: New Distribution Channels (10-15% captured by 2027-2028)

Genuinely new distribution emerges where it didn't exist or was minimal — and this DOES shift market share.

Embedded insurance platforms (Model 4) represent the largest near-term displacement. Automotive OEMs (Tesla), neobanks (N26, Revolut, Chime), enterprise software providers (SAP, Shopify), and digital marketplaces (Amazon) bundle insurance at primary transaction points. In P&C, embedded insurance grows. These platforms control the primary transaction (car purchase, bank account, ERP subscription), making insurance incidental — a fundamentally different distribution dynamic than traditional carrier, broker, or agent channels.

Affinity and brand partnerships evolve from traditional loyalty programs to digital embedded models. This channel expands in P&C. About half this growth represents genuinely new agentic embedded models (platforms using AI to dynamically select carriers); the rest is modernization of existing affinity programs.

Agent-to-agent autonomous commerce (Model 5) remains low through 2027-2028, constrained by immature digital identity infrastructure. Early pilots demonstrate viability, but scale requires 2-3 more years. By 2030-2033, this model grows as Europe's eIDAS 2.0 and similar frameworks mature.

Combined new agent-driven distribution: perhaps growing to 15-20% by 2033.

Type 3: Channel Compression (5-10% shrinkage by 2027-2028)

Some traditional high-cost channels lose share to AI-enabled alternatives.

Tied agents and branch networks shed percentage points by 2028 and more ongoing. This decline is primarily structural (cost, digital preference, generational shift) but agentic AI accelerates it by making direct and embedded alternatives more compelling.

Standardized broker business faces modest compression (2-3 percentage points) as simple products (personal auto, home, small business) shift to embedded platforms and AI-enhanced direct channels. Complex and specialty brokers retain share by becoming agent-discoverable experts (Model 2) for products requiring human judgment.

This 5-10% redistributes to:

Direct channels (+3 percentage points as AI improves self-service)

Embedded platforms (+3-5 percentage points captured from traditional channels)

Modernized affinity programs (+4 percentage points)

The Bottom Line: 10-15% ‘Displacement’, 85-90% ‘Transformation’

Today insurance is distributed through the channels shown above. The channels within the dotted lines all leverage non-insurance brands for distribution. ‘Fully Embedded’ here refers to the use of digital technologies to create more integrated, customizable and data-driven insurance solutions for non-insurance brands with more seamless customer experiences. We expect Agentic Commerce to accelerate the growth of Fully Embedded channels while transforming all others and displacing some.

New agent-driven channels capture 10-15% of market share by 2027-2028 — primarily more embedded insurance platforms bundling more coverage at primary transactions. This is significant ($50-80B in European insurance alone) but not catastrophic for traditional channels.

However, agentic AI transforms operations across 85-90% of distribution that remains in traditional channels. Carriers, brokers, and agents must adopt agent-accessible infrastructure (agent-parseable websites, API platforms, brand agents, digital identity credentials) to compete in channels they currently control. The strategic error is not failing to prepare for 10-15% displacement — it's failing to transform the 85-90% you still own.

The compounding risk: Insurance distributors that ignore agentic transformation lose 10-15% to embedded platforms AND suffer competitive disadvantage in the 85-90% that remains traditional. Carriers that deploy agent-accessible infrastructure across all five interaction models compete effectively in transformed traditional channels AND capture share of new embedded/agent-driven distribution.

The window for action is 12-18 months before algorithmic trust patterns solidify. Organizations that establish agent-first positioning now create 5-10 year structural advantages. Those that wait for "proof" face 3-5 year rebuilds when traditional channels complete their transformation and new channels scale to materiality.

Who Owns the Agent Layer? The Dual Battlefield

Who provides the consumer's AI agent? Who provides the enterprise's AI agent? Agents are emerging across two parallel battlefields: consumer agents for personal lines, and enterprise agents for commercial lines.

The Consumer (and SMB) Agent Battlefield

Big Tech AI platforms (ChatGPT, Google Gemini, Apple Intelligence): Apple Intelligence launching on 1.5 billion iOS devices could make Siri the default insurance shopping agent overnight. Amazon's Alexa extends naturally from general shopping to insurance.

Financial institutions (Chase, Bank of America, Capital One): They manage 150+ million digital customers' finances in the US alone and see insurance premiums. Adding "You're paying 23% more than you should for auto insurance — do you want better options?" to personal finance apps is a straightforward feature extension.

Specialized insurance platforms (Policygenius, Zebra, Insurify, CompareTheMarket): Face transformation from being ‘destination sites’ today to becoming ‘infrastructure APIs’ that consumer agents query.

Embedded insurance platforms (Tesla, Airbnb, Shopify, Amazon Marketplace): These platforms already bundle insurance into primary purchases, creating white-labelled distribution at point of sale. In the agentic era, their platform agents will query multiple carriers dynamically rather than maintaining exclusive partnerships. Tesla's agent queries 20 auto carriers at car delivery. Shopify's agent finds optimal merchant insurance for each online seller. AWS's agent embeds cyber coverage at cloud subscription. Small businesses must take mandatory product liability cover to sell on Amazon Marketplace.

The strategic advantage: These intermediaries control the primary transaction (car purchase, loan, listing, device, subscription) and add insurance incidentally. Consumers aren't "shopping for insurance" — they're buying something else and insurance is bundled. This creates invisible distribution where carriers compete dynamically to be selected by platform agents, not by consumer agents.

The Enterprise Agent Battlefield: The Hidden Threat

While insurers are starting to worry about ChatGPT disrupting personal lines, enterprise software platforms are embedding insurance shopping into corporate workflows:

Microsoft Copilot for Enterprise (345M+ seats): Integrated into CFO and risk manager workflows via Office 365, Teams, Dynamics 365. A risk manager asks "Review our D&O coverage and find better terms" — the agent queries carriers, analyzes gaps, generates RFPs within existing workflow.

Salesforce Agentforce & SAP Business AI: Know customer revenues, contracts, assets, liabilities through CRM/ERP integration. They have the exact data needed for commercial underwriting. Extending from "manage operations" to "optimize insurance spend" is simply a feature addition, not a pivot.

Procurement platforms (Coupa, SAP Ariba): Automate billions in corporate spending. Insurance is a line-item expense ripe for optimization. When Ariba adds "insurance procurement module," companies use it for insurance — especially standardized commercial lines.

Risk management platforms (Riskonnect, LogicManager): Already identify enterprise risks. Next step: "We've identified this risk — here are three quotes to transfer it."

The Multi-Front Strategic Reality

Personal lines carriers face 5-10 consumer agent platforms. Commercial lines carriers face 5-10 enterprise agent platforms. Multi-line carriers and specialty brokers face BOTH simultaneously.

You cannot predict which platform(s) will capture delegation, so you must be accessible to ALL. The precedent: From 2007, carriers built for both iOS and Android. Today, they must build for 10-20 platforms across consumer and enterprise.

The winning strategy: Build infrastructure ANY AI agent can query — whether serving a consumer comparing auto insurance or a CFO optimizing D&O coverage. This means API-first architecture, structured data, digital identity-verified agents, Model Context Protocol implementation, open documentation.

The window to become a preferred source across platforms: 12-18 months before confidence patterns solidify.

Bottom line: Don't ask "Which agent will win?" Ask "Can ANY agent—consumer or enterprise—discover, understand, and transact with us?"

The Missing Infrastructure: Decentralized Identity (‘DID’) Enables Agent Commerce

When your consumer agent negotiates with a carrier's brand agent, how does the carrier agent verify your agent has authority to bind you to a policy? How does your agent verify the carrier agent is authorized by AXA or State Farm to issue coverage?

Traditional API keys and OAuth solve discoverability — not trust. When Agent A at Broker X interacts with Agent B at Insurer Y and Agent C at Reinsurer Z, each needs cryptographically verifiable identity, granular authorization, and immutable audit trails.

This is the Decentralized Identity (‘DID’) layer — and it's becoming operational:

Europe's eIDAS 2.0 mandates government-issued digital identity wallets by November 2026, with businesses required to accept them by November 2027. Consumer agents will have government-verified DIDs from Day 1.

Groups like the Decentralized Identity Foundation are looking to work with insurance regulators (like EIOPA) on agent identity standards

Lloyd's Blueprint Two creates the opportunity to embed DID in London Market's digital infrastructure

The strategic reality: Carriers that build agent infrastructure WITHOUT identity verification will face the same trust crisis that plagued early e-commerce. Those that embed DID from Day 1 create defensible competitive moats.

When your brand agent offers quotes, it needs cryptographically verifiable credentials proving identity, authorization scope, data integrity, and regulatory compliance. Europe has mandated this infrastructure. Smart global carriers are building once, deploying everywhere.

The Internal Value: DID Infrastructure Pays for Itself Before External Agent Commerce Arrives

The business case for DID infrastructure doesn't depend on external agent commerce timing. The internal benefits alone justify the investment.

As carriers deploy dozens of specialist agents across underwriting, claims, customer service, and distribution, managing agent identities and authorities becomes critical. Without DID, organizations face credential sprawl — hundreds of API keys and service accounts requiring manual management, creating security risks and compliance nightmares.

DID infrastructure provides immediate internal value: granular authorization management, automated audit trails, secure agent workflows, and vendor integration standardization.

We expect large carriers to identify $5-15M annual savings from eliminating credential management overhead, reducing security incidents, and automating compliance reporting. $5-11M DID infrastructure investment pays back in 1-2 years from internal benefits alone — before capturing any value from external agent commerce.

This creates a risk-free migration path: build DID for internal agent governance in 2026, extend to trusted vendor partners in 2026-2027, open to consumer/enterprise agents in 2027-2028. Carriers capture immediate operational value while positioning for external commerce — rather than betting on external disruption timing.

Your 6-Month Action Plan: Sector-Specific Priorities

‘Agent-accessible' requires: API-first architecture, structured machine-readable data, clear AI-comprehensible documentation, and verifiable agent credentials.

Without this layer, "agent-to-agent" commerce defaults to pre-established business relationships requiring manual verification — exactly what agentic commerce eliminates.

What to do in the next 6 months

Month 1-2: Test discoverability. Ask ChatGPT, Perplexity, Google Gemini: "What's the best [your product] for [typical customer]?" and "Compare [your brand] vs [top competitors]." Document visibility gap.

Month 2-3: Expose pricing/coverage via RESTful APIs. Implement Model Context Protocol for agent interoperability.

Month 3: Identity Infrastructure Assessment

Evaluate DID providers and standards (W3C Verifiable Credentials, DIF specifications)

For EU operations: Begin eIDAS 2.0 integration planning

Pilot issuing verifiable credentials to first brand agents

Month 3-4: Restructure website content for AI comprehension. Implement semantic markup and agent-readable product catalogs.

Month 4-6: Launch Level 2-3 specialist agents for specific product lines. Test agent-to-agent negotiation protocols.

What this means for different sectors

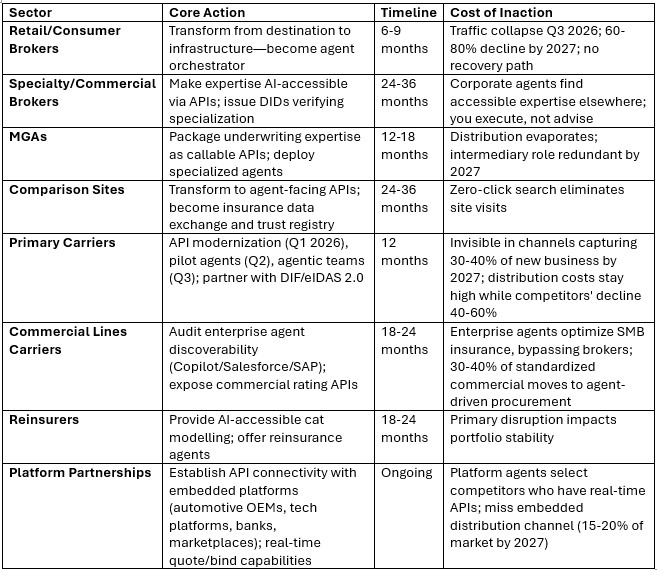

Here’s what we recommend for different insurance industry players:

You can agree or disagree with the timelines here - they are a guide not a forecast. But inaction is the worst response.

Implementation Reality Check

Some more objections you might hear and how to respond to them:

"We don't have budget" → We're already spending millions on legacy API maintenance, SEO, and comparison site fees. This redirects existing spend toward agent-first infrastructure. The question isn't whether we can afford it — it's whether we can afford NOT to redirect spend flowing to channels about to collapse.

"IT is at capacity" → Then competitors will capture our market share across all fronts. This is a forcing function for organizational capability. Outsource to SIs if necessary, but the timeline is market-driven, not resource-driven.

"Our distribution partners will resist" → Independent agents complaining about carrier-direct in 2000 didn't stop the internet. Broker resistance to consumer agents won't stop algorithmic shopping. Let’s lead the transformation or become irrelevant alongside resistant partners.

"We need more proof" → By the time "proof" exists at scale you want, visibility patterns will have solidified. First movers in SEO captured decade-long advantages because they were first. The same dynamics apply with algorithmic trust — but they are amplified because AI systems converge on reliable sources faster than humans.

The organizations succeeding with this playbook aren't smarter or better resourced. They're executing while competitors debate.

Conclusion: The Visibility Imperative

Agentic commerce isn't coming to insurance — it's here already. Within 18-24 months, consumer agents will conduct automated policy reviews across dozens of carriers, broker agents will negotiate directly with carrier brand agents, and comparison platforms will operate as agent marketplaces.

The narrow window for action is closing. Early visibility patterns are solidifying as AI systems build confidence in reliable, agent-readable sources. Organizations that establish agent-first positioning now will create persistent competitive advantages.

Picture this scenario: Q4 2026. A customer asks their iPhone's Apple Intelligence: 'What's the best auto insurance for me?' The agent queries 50 carriers, receives structured quotes from 35, and shortlists 3 based on coverage-to-cost ratios your human marketing team never optimized for. Your brand isn't in the shortlist — not because your pricing is wrong, but because your pricing isn't parseable by Apple's agent.

The same customer might have asked ChatGPT, Google Gemini, their Revolut banking app, or Policygenius's agent platform. A CFO might have asked Microsoft Copilot or SAP's enterprise agent. You don't know which agent will capture which customer — you only know that if you're not accessible to all of them, you're invisible.

The strategic choice is binary: Lead the transformation to Level 5 agent ecosystems, or become invisible to the algorithms that increasingly mediate all insurance distribution.

The playbook exists. The technology is proven in production. The business case is quantified. The question is no longer whether agentic commerce will reshape insurance — it's whether your organization will be visible when the agents come shopping.

Simon Torrance leads AI Risk, advising companies on Agentic AI strategy and implementation. AI Risk’s Agentic AI Maturity Model maps transformation paths from traditional automation to Level 5 ecosystem agents.