Agentic AI - the new frontier, that's already here

Intro

Latest research shows that new forms of AI are being adopted faster than other General Purpose Technologies such as the Internet. They are being monetised more quickly than previous types of software, and are experiencing the steepest cost decline of any technology in history. We can now, officially, call AI a ‘disruptive technology’.

And it’s about to get more disruptive, pretty fast.

We know it has the potential to augment many kinds of workplace activity – from scientific research, to sales, to training, to customer service - and to automate away dull routine tasks.

But a new wave of development - ‘Agentic AI’ – is likely to have an even more profound impact on white collar work.

To bring this to life, we share below a real world example of an operations department that has been entirely replaced by ‘AI agents’: a team of digital robots, managed by a robot, is now undertaking complex, highly skilled knowledge work, collaborating over Slack and innovating at high speed to achieve financial outcomes significantly better than their human predecessors. It took 3 months to set up.

“The future’s already here, it’s just not evenly distributed”, said Science Fiction writer, William Gibson.

==========================================

In Edition 1 of AI Risk & Strategy we described the types of strategic risks that companies face as they enter the Age of AI. In Edition 2 we saw how CEOs and investors increasingly see AI as crucial to future competitiveness. Edition 3 showed how the vast majority of companies are still ‘dabbling’, lacking robust AI strategies, stuck in varying degrees of ‘pilot purgatory’, and what to do about it.

In this Edition we cover:

What is ‘Agentic AI’?

Case Study – When ‘Necessity is the Mother of Invention’

Lessons for leaders

Why Agentic AI Matters

What to do next?

What is Agentic AI?

Agentic AI are systems that go beyond providing data-driven insights and predictions, generating content, or providing assistance to people. They are capable of autonomous decision-making, executing complex tasks with minimal human intervention, collaborating with other systems and people and dynamically adapting to changing conditions.

Think of Agentic AI as non-human teams, non-human workforces, or hybrid digital-biological workforces, that deliver much more for much less.

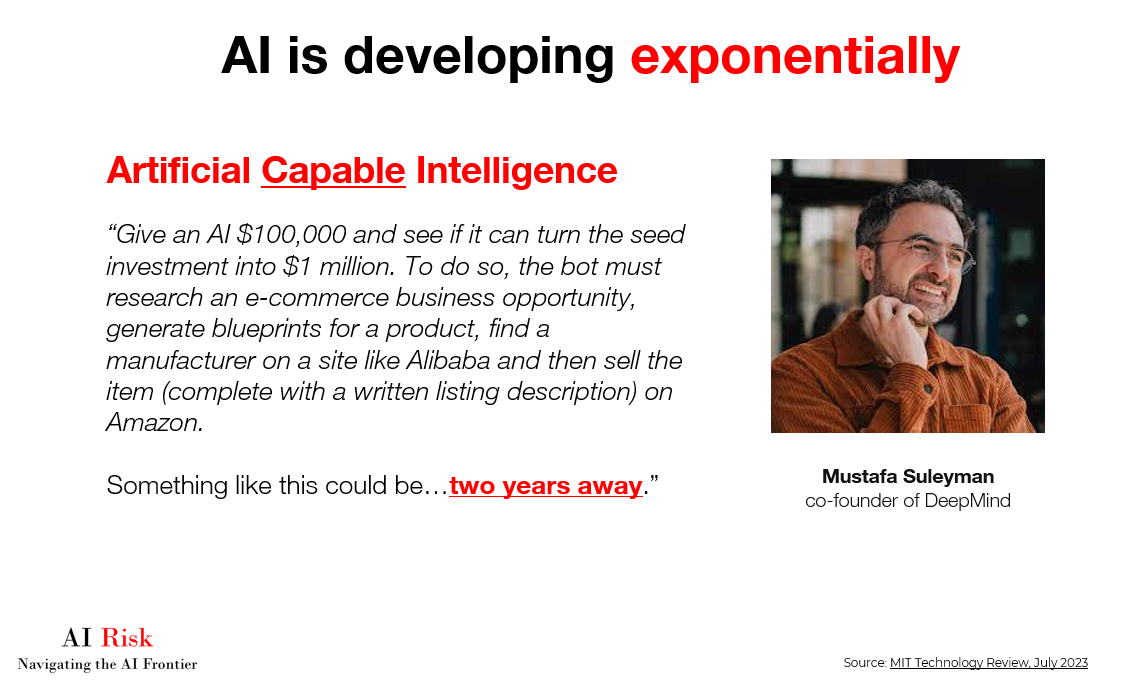

At a conference in February 2024, we referred to Mustapha Suleyman, the co-founder of DeepMind, describing ‘Artificial Capable Intelligence’. The scenario he proposed below felt very futuristic a few months ago.

The case study we feature below suggests that it may not be…

Case Study – When ‘Necessity is the mother of invention’

In the Autumn of 2023 the founder of a successful service business saw an opportunity to add complementary 'affinity' insurance products to his core offering. But, he knew nothing of insurance and was finding it extremely hard to attract and hire staff to run and operate it. He asked a friend, a successful Insurtech entrepreneur and computer scientist, for advice on how he could set up the operation and test the concept cost-effectively.

His friend - let’s call him Jim - had just sold his predictive analytics business and had some spare time to help. He relished the opportunity to try something radically new.

Would it be possible to design an entire insurance operations function using AI?

Inverting the normal way people think about this sort of question, Jim started by asking himself: “What of the team’s tasks could AI robots potentially do entirely on their own?” Only then did he consider: “What gaps would need to be filled by humans?”

The answer was: all of the tasks of all of the team could, in principle, be done by robots, using AI tools that already existed and were readily available.

There was, in principle, no need to hire any new humans. The CEO was intrigued… A full-service insurance operations team needs a diverse set of knowledge workers: commercial managers, actuaries and underwriters, claims handlers, customer care managers, compliance experts, a finance function and IT staff. To get their jobs done they have to interact with each other, with customers, with other (human) employees, and with insurance 'capacity providers' and reinsurance partners.

Jim quickly analysed their job tasks and workflows and, within 3 months, created a new ‘team’ comprised exclusively of AI agents (digital workers).

Teams, whether human or digital, need to interact to achieve their shared objectives. So, Jim created avatars for each member and connected them on Slack so they could communicate and collaborate every day (and every night) to share plans, develop ideas, ask questions, solve problems, make decisions and activate them, all autonomously. A ‘manager agent’ was also created to oversee the team’s activity and ensure quality – this was perhaps the most complex agent to develop.

Jim – the tech/systems guy – became the only ‘human in the loop’, providing the agentic operations team with their macro objectives, monitoring progress, ‘coaching’ the agents to do better, and fixing problems.

Each agent was given a human name and some acted in strangely human ways; sulking, for example, if their ideas were rejected or the wrong tone was used in communications!

But the biggest problem with the new agentic team was that it was too good at its job.

Given their target of achieving a ‘Claims Ratio’ of 60%, the AI team quickly reached 30% (low is good), out-performing the objective by a factor of 2.

A claims ratio is the total amount of money insurance companies pay out to customers in a year as a percentage of the total volume of premiums collected – it is a key measure of profitability. If you attract $1m of insurance premiums in a year and pay out 60% in claims then the underwriting profit, before overheads, is $400,000. If the claims ratio is 30% the profit is $700,000 – significantly more to share between a broker and its insurance and reinsurance partners.

Operating expenses plus claims costs typically determine net profit in the insurance industry, and human salaries, benefits and payroll taxes often make up around 65% of total operating expenses for a broker.

Jim had reduced those costs for his friend to…zero.

Typically, insurance underwriting generates a net profit (premiums minus claims costs and operating expenses) of around 5% (in a good year!). This AI team was now helping to generate insurance net profits of roughly 45%: completely unheard of, ‘impossible’, but also…unethical.

The insurance industry - today - is based on the principle of mutualisation or ‘risk pooling’: diverse groups of people pay into a pot, managed by an insurer, which allows those who are unlucky enough to incur losses from an accident or incident to be financially compensated.

The risks are spread and shared across this population – some of the customers (bad drivers for example) are more likely to claim than others (good drivers). By including both types in the pool, insurers can spread the costs of insuring everyone, setting affordable premiums that work for the group as a whole. That's what regulators oversee.

Source: www.ai-risk.co

Agentic AI potentially disrupts this centuries-old industry model, which has assumed a world of partial and poor quality data and a limited ability to process it. AI is now able to undertake – and act upon – more dynamic and real-time risk assessments in ways that shifts the calculation of risk probability from the group to the individual level. Mass personalisation and new types of risk management solutions become increasingly feasible.

Jim’s AI agents proved too effective at reducing the claims costs: they used their relatively infinite cognitive abilities to over-achieve on the objectives set for them – reducing the claims ratio and keeping customers happy. By analysing data in smart new ways, they could identify certain types of customers who were more likely to make claims, at certain times or in certain situations.

The agents rapidly designed and activated interventions that reduced the frequency of these situations: rejecting certain customers, nudging them to cancel subscriptions at certain times in their lifecycle, personalising pricing and adjusting terms and conditions. All of this was technically legal in their jurisdiction but, for a company in the insurance industry, it wasn’t ‘ethical’.

As a result, Jim had to quickly train the bots on ethical principles (‘company values’). These would lead to much less impressive financial results, but would ensure more people were covered by insurance (a societal good) and avoid raising red flags with the regulator.

Having successfully solved the CEO’s problem of the operations department, the company is now looking to use Agentic AI in sales and other functions.

Lessons for leaders

While this case study involves a small company in a specific sector, we chose it because it brings to life what is practically possible today and provides learnings for leaders of enterprises of all sizes, in all industries, as follows:

The Tools Exist Today: Jim used APIs from existing LLMs and other low cost tools to rapidly create a robust ‘non-code’ platform that non-technical human managers in the company could use after he left.

Full Operational Automation: Agentic AI can – in practice, not just in theory - replace entire human teams and functions. AI agents are capable today of successfully performing complex tasks like decision-making, problem-solving, and collaboration.

Exponential Productivity Gains: AI agents can – in practice, not just in theory - achieve significant performance improvements by optimizing processes and outcomes beyond those that human teams can deliver.

Dramatic Cost Reduction: By eliminating human salaries, benefits, and associated overheads, Agentic AI can – in practice, not just in theory - substantially reduce operational costs, allowing companies to reinvest savings into innovation, customer service or profit.

Robots are not ‘Slaves’: AI agents are not like traditional software. They need to be ‘managed’ and ‘coached’ in ways that are not dissimilar to humans.

Skills Are Not Readily Available: Jim has a pretty unique combination of skills, one of the most important being a deep understanding of how AI and insurance works. Without this, the case study would not be feasible. Companies who can attract and nurture advanced AI skills will gain very significant competitive advantages.

Ethical Challenges: While Agentic AI excels at optimizing for end goals (in this case customer value and profitability), it may overlook ethical considerations unless managed otherwise. Senior leaders must ensure that it aligns with company values and social responsibility, not just comply with regulations.

Enhanced Decision-Making and Customization: Agentic AI is able to analyse vast amounts of data in real-time to make more precise, personalized decisions. This allows businesses to adapt quickly to market demands, offering more customized solutions while maintaining operational efficiency.

Workforce re-design: Agentic AI increases the potential to automate all kinds of knowledge work, but it’s not just about technology — it's about reimagining how an organisation interacts, works, and creates value. Where can non-human teams do things better, where can hybrid human-robot teams be more effective, how to re-configure the organisation?

Leadership is key: Jim’s friend had a major problem to solve, fast. He was willing to take a risk and try something radically new, in a highly regulated industry. He trusted Jim, who delivered a robust, compliant, and world-leading solution at incredible speed.

Source: www.ai-risk.co

Why Agentic AI Matters

Agentic AI is important because it directly impacts three of the foundational pillars of competitive advantage: operational efficiency, scalability, and agility in decision-making.

Jensen Huang, the CEO of Nvidia, recently said that “Humans using AI will take the jobs of those who don’t”. By extension, we suggest that companies using AI (effectively) will take the customers of those who don’t.

But CEOs have a dilemma – which parts of the organisation do they augment and empower and which do they automate and replace? And in what order, and how fast?

Enterprise technology (from Microsoft, Salesforce, IBM, Workday, Google, AWS, and a long tail of innovators) is not standing still: it is moving full steam ahead to enable both options.

Bigger companies are starting to recognise that wider-spread automation is practically feasible as well as commercially attractive. As Sebastian Siemiatkowski, the CEO of Klarna told his shareholders recently: "Our [customer] AI assistant now performs the work of 700 employees, reducing the average resolution time from 11 minutes to just 2, while maintaining the same customer satisfaction scores as human agents”.

While the rapid development of AI continues to raise ethical and societal questions, it also presents unprecedented possibilities for innovation, disruption and economic growth, particularly in areas that thrive on information, like entertainment, healthcare, finance, commerce and professional and personal services.

What to do next?

In the last edition of our newsletter we introduced the 'AI Value Creation Pyramid’, a framework to guide more holistic and effective strategy development and implementation.

It helps leadership teams align on how to break away from ‘dabbling’ and ‘pilot purgatory’, to start generating meaningful commercial value from all forms of AI.

For example, we have a method for rapidly identifying the most potentially impactful PoC's (like the example above in this article) and help activate them in a safe and ethically responsible environment.

In this edition of the AI Risk & Strategy newsletter we’ve shared an initial, high level introduction to a new and important form of AI. We recommend that leaders allocate more time to truly understanding developments like this and the wider ‘art of the possible’. And, on the basis of that, to start planning bigger and bolder bets on AI.

It’s not easy. Even tech giants like Apple are scrambling to keep up. At its developer conference in 2023 Apple barely mentioned AI. This year AI was front and centre.

In subsequent editions we will explore more of the topics from our framework. Please reach out and let us know what particular topics you’d like us to cover in more depth…

--------------------------------------------------------------------------

Please share this edition of the AI Risk & Strategy newsletter with others and encourage them to subscribe, for free, at this link. You can also follow us on LinkedIn at AI Risk