The Agentic AI Accelerator for Insurance

For CEO/COOs ready to transform operations and distribution before the window closes

For over a century, insurance has been constrained by a single factor: the need to hire, train, and retain expensive professionals to perform cognitive work. Underwriting. Claims. Customer service. Risk evaluation. This constraint has defined your cost structure, your capacity, and your competitive position.

That constraint has lifted. Agentic AI enables you to scale cognitive work like software — deploying instantly, operating continuously, improving automatically.

This isn't process automation. This is a fundamental change in insurance economics.

Infinite AI Workforce strategy in 4 weeks

Holistic plan: PoCs → Enterprise Scale

Vendor/Platform-agnostic

Neutral solutions that easily integrate with your stack

Change Management baked in

New metrics, new org units, new skills

Two Transformations, One Accelerator

Most AI initiatives focus inward — automating claims, underwriting, service. We address both dimensions:

Operational Transformation

Scale your workforce capacity without scaling headcount. Deploy autonomous systems that handle complete workflows — from first notice of loss through settlement, from submission through bind.

Distribution Transformation

As consumer AI agents (Apple Intelligence, ChatGPT, Gemini) and platform agents (at OTAs, retailers, neobanks) begin mediating insurance purchases, your products must be visible and transactable to reasoning systems. Insurers invisible to AI agents won't reach the consideration set.

The Agentic AI Accelerator positions you for both

What This Unlocks for Insurers

Measurable Outcomes:

Increased profitable revenue, optimised cost structures, and differentiated customer experiences.

Underwriting

Autonomous analysis of risk portfolios, market research, and recommendation preparation — 24/7. Your underwriters focus on complex risks and relationships.

Claims:

Forge executive consensus on where to play and how to win with Agentic AI while mitigating implementation risks.

Customer Service

Handle inquiries, policy changes, and claims guidance at scale — improving satisfaction while escalating only complex situations

Distribution

Become discoverable, comparable, and selectable by AI agents. Position for embedded insurance and agent-to-agent commerce before competitors

Capacity

Expand into markets, products, and segments currently uneconomical to serve — without proportional headcount growth.

The Competitive Clock Is Running

First-mover advantages in agentic AI compound monthly. Competitors deploying today will build leads in

Unit economics

Lower operational costs enable aggressive pricing

Service capacity

Ability to serve segments unprofitable for you

Processing speed

Claims and underwriting at higher velocity

Organisational learning

AI systems that improve with every interaction

These advantages are not recoverable through catch-up efforts. The window for strategic positioning closes within 12-18 months.

Why AI Risk for Insurance

Read The Blueprint To Realise Your Agentic Potential

-

Our engagements produce operational AI capabilities integrated into your environment — not slide decks.

-

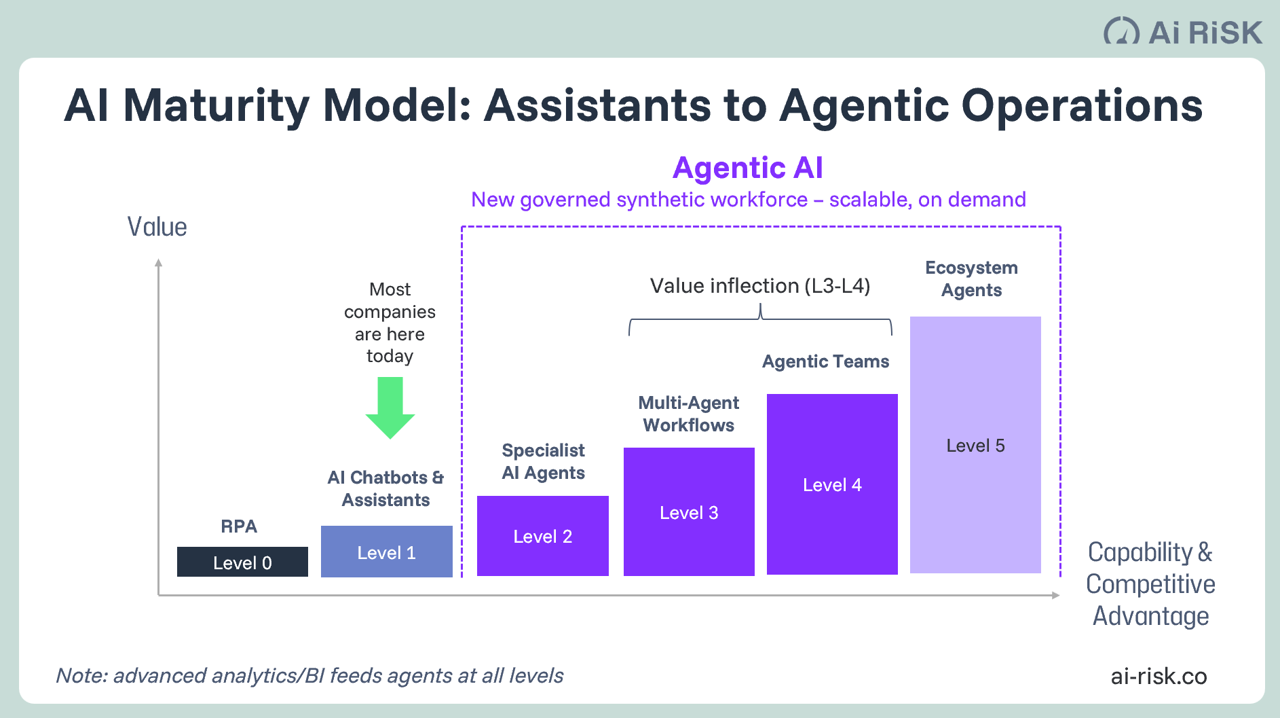

While others pilot basic assistants, we implement autonomous agents and multi-agent teams handling complete workflows.

-

20+ years of senior executive experience across carriers, MGAs, and brokers. We know your regulatory environment, your underwriting disciplines, your operational realities.

-

Microsoft, Google, AWS, Guidewire, LangChain — we integrate what works for you, not what earns us commissions.

-

We escape pilot purgatory. Our Agentic Transformation O/S provides the infrastructure for systematic, wave-based expansion — not isolated experiments that never scale.

Proven Results In Insurance

70% Automation

Contact Centre Operations

70% automation achieved while improving customer satisfaction, underwriting profitability, and regulatory compliance.

99% Efficieny

Complex Analysis

Six-week processes compressed to one hour with agentic teams handling data gathering, synthesis, and reporting.

3x Growth

Operational Capacity

Strategies for 3-10x expansion within 24 months — market entry without proportional headcount increases

The Accelerator: Five Phases to Transformation

-

Phase 1

Executive Illumination & Strategy (3-4 weeks)

Leadership alignment through executive workshops, live demonstrations of Level 3-4 systems, and creation of your strategic hypothesis and transformation roadmap.

Stage-gate: Go/No-Go based on strategic alignment and clear ROI.

-

Phase 2

Phase 2: Solution Planning & Architecture (4-6 weeks)

Detailed design of 2-3 priority solutions and establishment of your Agentic Transformation O/S — the foundation for systematic expansion.

Stage-gate: Go/No-Go based on solution feasibility.

-

Phase 3

Rapid Testing & Infrastructure (6-18 weeks)

Parallel development of proof-of-concepts and prototypes. Working Level 2-4 systems operating on your data, validated for real workflows.

Stage-gate: Go/No-Go based on measured business impact.

-

Phase 4-5

Scale-Ready Strategy & Enterprise Activation

Production deployment, governance frameworks, training programmes, and continuous optimisation.

Each phase includes rigorous stage-gates. You're never locked in if we don't deliver results. All work product remains yours regardless of decisions.

Timeline To Impact

Initial results:

6-12 months

Transformational capacity:

24 months

Structural competitive advantage: 24-month lead over competitors starting later

Next Steps

The competitive window is closing.

Step 1

Executive Briefing

30-minute session to assess strategic fit

Step 2

Demonstration

See Level 3-5 agentic systems in insurance contexts. See AI Maturity Article here…

Step 3

Decision

Determine whether to proceed with Phase 1

The Winners Are Already Scaling Agentic Teams Now

The Agentic Enterprise Blueprint maps your transformation from pilot purgatory to exponential scale.